Our Holistic Approach

In the age of robo-advisors and boilerplate guidance, we go against the grain.

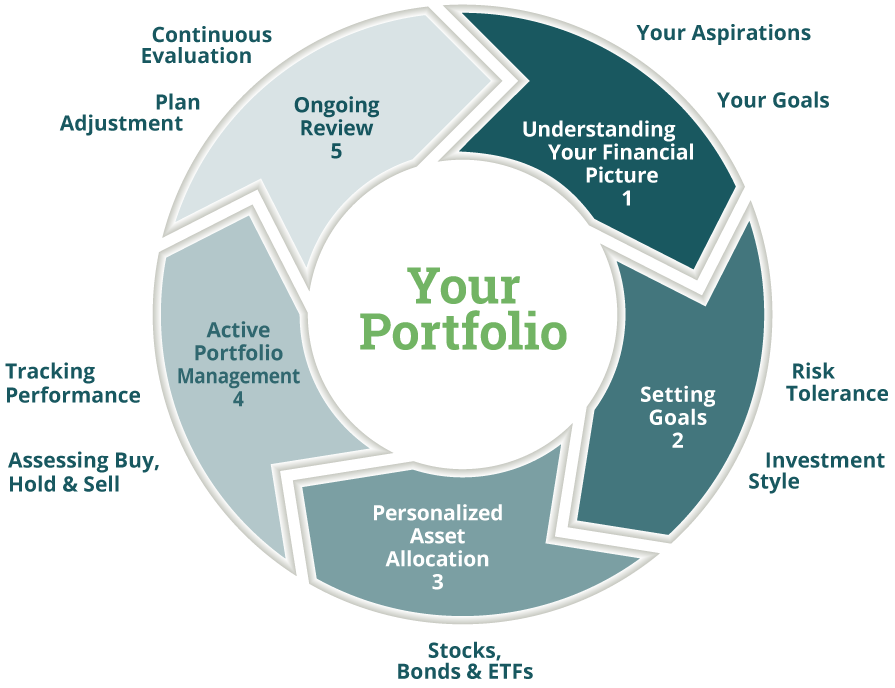

The Penobscot Process

We believe in quality over quantity, so we work with a limited number of individuals, families, and institutions. As a result, each member of your Penobscot team will be familiar with your plans and needs—and contribute their skills to help you create your best life.

Active Portfolio Management

At Penobscot, we design each client’s portfolio from the ground up—selecting investments that we believe best fit your goals and investment preferences. We invest primarily in individual stocks and bonds as we believe they offer the most transparency and give us the most control in helping you achieve your goals. Your goals are our guideposts.

Investment Principles

Penobscot seeks to preserve and grow your capital by investing in companies that have proven financial results. To accomplish this mission, Penobscot uses a fundamental approach to select a low-turnover stock portfolio of well-managed large-, mid-, and small-cap companies with a high probability of sustainable earnings from a universe of 1500 companies.

For a company to be included in a Penobscot portfolio, the company must possess both competitive advantages and the cash flows to survive difficult economic cycles. We carefully analyze financial statements to identify investments with fundamental characteristics that indicate they will perform in any economic environment.