From a market standpoint, the 2010s will be remembered as a decade of slow but steady gains, and a time of sustained growth for investors.

From a market standpoint, the 2010s will be remembered as a decade of slow but steady gains, and a time of sustained growth for investors.

The 2010s was the first decade on record that the U.S. didn’t experience a single recession. The stock market had trivial spells of volatility but every correction proved to be a buying opportunity.

Why was the past decade such a remarkable run? The first decade of the 21st century was a debacle. It included two recessions, one being the worst economic crash since the Great Depression in 2008 and two massive stock market crashes in 2000 and 2008.

The 2000s are often referred to as “The Lost Decade,” with the S&P 500 finishing the decade 24% lower than it began. The Dow Jones Industrial Average ended 2009 at 10,428, losing more than 1,000 points over 10 years.

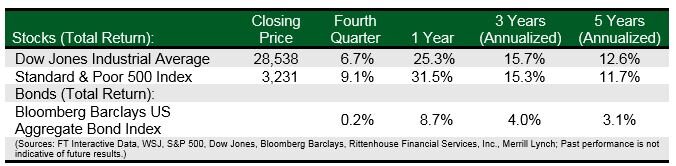

Fast forward a decade later, the S&P 500 climbed 190%, and the Dow Jones Industrial Average ended 2019 at 28,538, 174% higher, gaining a whopping 18,110 points over 10 years.

There were underlying themes supporting the market throughout the decade. Low interest rates, an accommodative Federal Reserve Board, corporate tax cuts, a strengthening US dollar, tremendous growth in technology, and synchronized global growth.

As we enter a new decade, we still believe the economy is on solid ground with a few headwinds. Consumer confidence is relatively high, unemployment remains at historic lows under 4%, wage growth has returned, interest rates remain low, frictions between the US and China are diminishing, and inflation remains tepid, all positive backdrops for the market. Some cautions for 2020 include, continued slowing in corporate earnings growth, global growth and business spending as well as, uncertainty due to the upcoming elections.

What will cause the market to turn? Like a black swan in the night sky, you can never see it. For example, renewed conflict in the Middle East is occurring as we write this letter. The only way the bull market persists is if investors continue to believe in the positive narratives that propelled the gains over the past decade. If history is a guide, at some point investor sentiment will change. When remains an unknown.

In 2018, the S&P 500 recorded its first negative return since 2008. A frustrated investor may have exited the market and missed out on the record-breaking year in 2019 when the S&P 500 returned 31%. Similarly, an investor who exited the market at the turn of the decade in 2010 would have given up the 190% return the S&P 500 has experienced over the past 10 years.

In conclusion, at the end of last year’s letter we reaffirmed our commitment to our long-term investment strategy which remains true in any market cycle and as the new decade dawns. We are steadfast in our long-term investment focus on market-leading companies with global operations, strong balance sheets, and consistent records of earnings and dividend growth. As another year begins, we reaffirm our commitment to common stocks, patience, and realistic expectations as the best combination for long term capital appreciation and income growth.

All of us at Penobscot wish you a healthy and prosperous New Year.