A Letter from our President

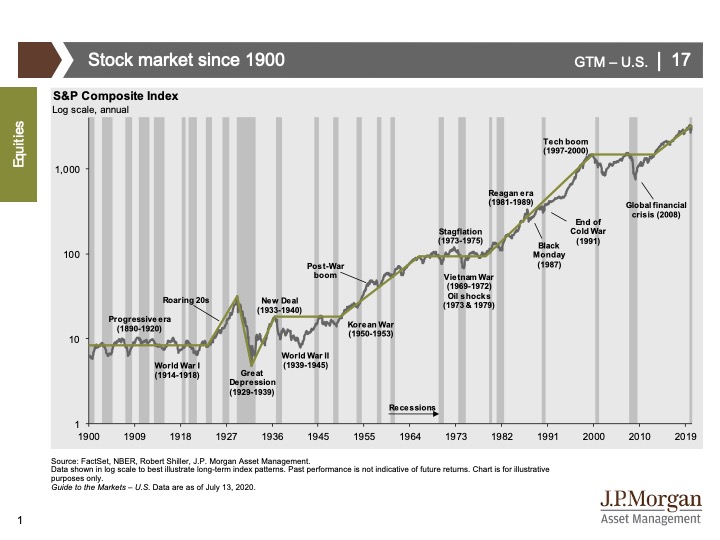

We are all experiencing the winds of great change, both socially and economically. Surprisingly, the stock market, which is a forward-looking indicator, seems unfazed, rising as much as 44% off its bottom in late March. The broader economic indicators, many backward-looking, paint a vastly different picture and seem to indicate that we have slipped into a recession. Despite the setbacks, incremental rises in returning jobs and retail re-openings – a key economic indicator – continue to set the stage for a slow recovery.

Going forward, we will continue to experience changes both as individuals and as a collective society. Through this volatility, Penobscot remains committed to its core philosophy of investing in well capitalized companies with solid prospects for price appreciation and dividend growth. We believe that companies which meet these criteria will manage through the current storm, and arise as leaders in the world within a new normal.

Every portfolio we manage is guided by this philosophy, and we continue to work as one firm to ensure your investments align with your long-term financial goals. The volatility may seem frightening and when markets are falling it’s tempting to want to sell stocks, but that is usually the worst time to adjust your portfolio. Our job is to keep you focused on your long term objectives, not the day-to-day gyrations. We are here to help you in any way we can. Thank you for instilling your trust in us.

Stay healthy & safe. – Dan Ford, President

Perception is Everything

Perspective was the theme of our first quarter letter when the S&P 500 Index declined precipitously from a 52-week high of 3394 to 2192, a drop of 35%. By the end of the second quarter, the S&P recovered to 3100 which is up 20% for the quarter, down only 4% year-to-date, and 9% below the 52-week high. What changed so dramatically in such a short period of time? While perspective is useful in explaining something in the context of history, perception is useful in looking ahead.

Perspective was the theme of our first quarter letter when the S&P 500 Index declined precipitously from a 52-week high of 3394 to 2192, a drop of 35%. By the end of the second quarter, the S&P recovered to 3100 which is up 20% for the quarter, down only 4% year-to-date, and 9% below the 52-week high. What changed so dramatically in such a short period of time? While perspective is useful in explaining something in the context of history, perception is useful in looking ahead.

In three short months, we know much more about the risks of Covid-19 and most of us have learned how to behave individually and collectively to manage those risks. We also know much more about the effect of that behavior on consumption and investment patterns. Consumers have found new ways to engage in commerce through the internet and to communicate through electronic conferencing. Capital is fleeing traditional industries like energy exploration and finding new opportunities in businesses with the promise of technological efficiencies. Each of us has a new perception of what is useful and important to us. Our changing consumption patterns and preferences will shape the outcome of the transformation that is taking place in the economy.

One perception is that the economy will remain stagnant. There are real concerns that continuing loss of life from Covid-19 and Great Depression levels of unemployment may have adverse effects on the economy indefinitely. There are many negatives and uncertainties like these that may be the sources of downward pressure on financial markets for years to come.

Another perception is that we are gradually moving toward better times. Unemployment is holding at 11% in the latest reports and is not at Great Depression levels. June’s jobs report was positive. Inflation and interest rates remain at unprecedented low levels. In this difficult economic environment, well-managed companies with good balance sheets are holding their own in their efforts to sustain earnings and dividends.

Perceptions both negative and positive will most certainly fuel market volatility for the foreseeable future. Predicting corporate earnings is especially difficult at this time. Stock pricing is very challenging if one believes as we do that a stock’s current price represents the total of future earnings and dividends discounted back to their present value. However, unpredictability in the next few quarters is only part of pricing the value of a good company. Investors need to take into consideration a company’s short- and long-term prospects.

While we believe the market as a whole may be somewhat overvalued at the present time, the broad market includes companies and industries that are facing particularly difficult challenges, such as travel, leisure, and energy companies. There are segments of the economy such as restaurants and on-site retail businesses that may never recover fully from consumer behavior changes.

At the same time, some companies are prospering as consumer demand reshapes the economy with benefits accruing to the health care, consumer staples, and technology sectors. While the broad market represents the ups and downs of the overall economy, there are economic sectors shaped by changing perceptions and preferences that will reward investors. Our focus will continue to be on income growth and capital appreciation in well-diversified portfolios of high-quality dividend-paying stocks. It is with a positive perception that we look ahead.

Communication has always been important in the way that Penobscot conducts its portfolio management services and client relationships. Good communication is as important as ever in these challenging times. We are in this together, which is why we welcome your questions and feedback. Enjoy a relaxing and fulfilling summer, and let’s continue to look forward.

College Savings – Traditional Brokerage Account or 529 Plan?

College Savings Plan Options

A college education is one of life’s most important investments, the success of which can have a major impact over one’s lifetime. The average college-educated person makes approximately $1 million more during their lifetime than a non-college- educated person. However, the continually rising cost of higher education leaves our children and grandchildren facing the prospect of living with debt for years to come. More than 44.7 million Americans have student loans on file and, according to the Federal Reserve, the average college debt among student loan borrowers in America is $32,731. Of course, many young people today are strapped with much higher debt. On a positive note, there are several ways that you can help.

The two investment options for college savings most frequently leveraged are a 529 plan and a brokerage account. Many of you have children or grandchildren that you would like to support in their college efforts, so we’ve broken down some pros and cons of these two popular options.

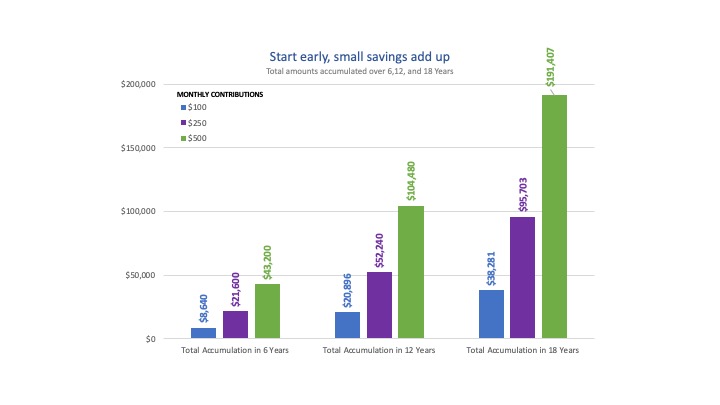

Whether you choose a 529 Plan, a brokerage account, or a combination of both, the earlier you start the easier it will be to build the all-important college nest egg. Also, keep in mind that the window to college is much shorter than the window to retirement, and your asset allocations should reflect this reality.

Please let us know if you would like to schedule a time to talk about setting up an account for your children or grandchildren. It is easier than you think – and in no time, you will be well on your way to making a tangible investment in your children’s or grandchildren’s future. Contact Colleen MacPherson for information.

Source: JP Morgan Asset Management.

This hypothetical example illustrates the future values of different regular monthly investment for different time periods. Chart also assumes annual investment return of 6%, compounded monthly.

Colleen MacPherson, CFA is Promoted to Director of Research

We are proud to announce that Colleen MacPherson, CFA has been promoted to Director of Research. In her new role, Colleen will oversee the firm’s research efforts to identify opportunities in equities, fixed income, and other asset classes, while continuing to service clients as Portfolio Manager.

We are proud to announce that Colleen MacPherson, CFA has been promoted to Director of Research. In her new role, Colleen will oversee the firm’s research efforts to identify opportunities in equities, fixed income, and other asset classes, while continuing to service clients as Portfolio Manager.

Prior to her tenure at Penobscot Investment Management, she was a Fixed Income Product Manager at Eaton Vance as well as a Banking Specialist at Brown Brothers & Harriman.

Colleen holds an MBA from the Franklin W. Olin Graduate School of Business at Babson College, and a B.S. in Accounting from the University of Massachusetts, Amherst. She was a National Collegiate Scholar and graduated cum laude. Colleen has earned the Chartered Financial Analyst ® designation and is pursuing the Certified Financial Planner certification. She is actively involved with Dana-Farber Cancer Institute as a member of its Leadership Council, and has run several marathons to benefit Dana-Farber. In addition, she is a member of the Boston Business Associates’ Club and the CFA Society Boston.