A Letter from our President

Investing in Your Future

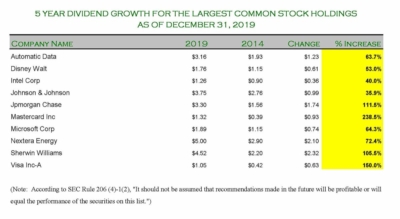

Since our founding in 1988, Penobscot has focused on high quality, dividend-paying stocks for our client portfolios.

Since our founding in 1988, Penobscot has focused on high quality, dividend-paying stocks for our client portfolios.

When corporations earn profits, they can choose to share those profits with their shareholders in the form of dividends. Most dividend payments are made on a quarterly basis, and as investors get closer to retirement, these dividends can play a crucial role in helping to supplement working income. When analyzing dividend-paying companies to determine where to make your investment, it’s important to find those that pay a steady and growing dividend. This is only possible for companies that maintain sound balance sheets.

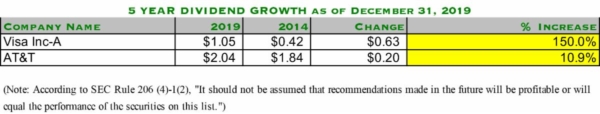

We invest in companies that grow their dividends at a rate substantially higher than inflation as shown below. Let’s look at the example of two dividend-paying companies, AT&T and Visa:

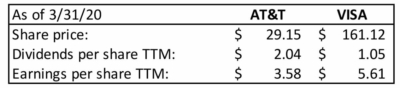

Many people look at dividend yields as a gauge of how attractive a dividend-paying stock is:

AT&T: 7.0%

VISA: 0.7%

But consider how these numbers are calculated:

AT&T: dividends per share/share price = $2.04/$29.15 = 7.0%

VISA: dividends per share/share price = $1.05/$161.12 = 0.7%

An investor seeking to maximize yield would prefer AT&T over Visa. However, a company with consistent earnings growth typically experiences an increasing share price which reduces their yield. For these reasons, the growth of the dividend and the dividend payout ratio are much more important factors to us.

As you can see in the exhibit below Visa has increased their dividend by 150% over five years, while AT&T increased their dividend only 11%.

The dividend payout ratio is the percentage of earnings being distributed as dividends. The lower this ratio the more likely a company is to sustain and grow its dividend. AT&T uses 57% of earnings to distribute dividends, while Visa uses only 19%.

Even though Visa has a much lower yield, it is more attractive to us because Visa is growing their earnings and increasing their dividend at a much faster rate.

Penobscot seeks companies that have a consistent record of earnings and dividend growth, combined with a modest payout ratio. Our team focuses on long-term capital appreciation and income growth, exercising patience and consistency throughout the process.

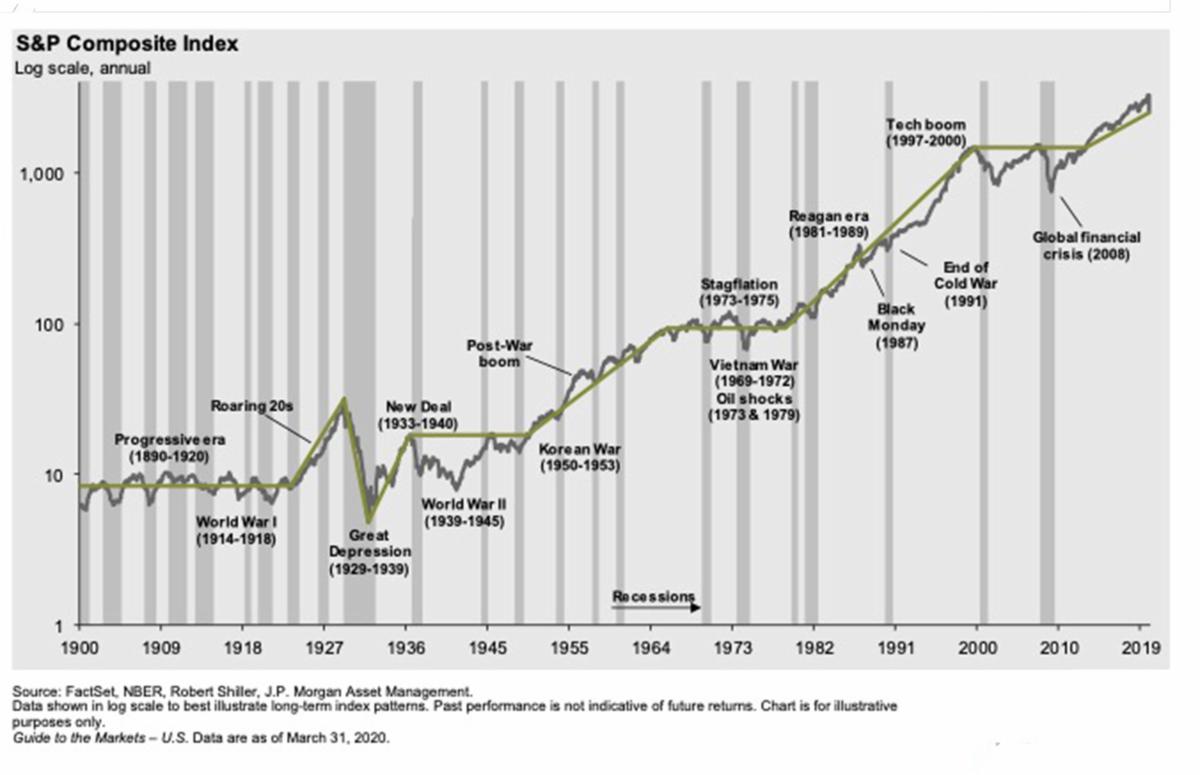

Taking the Long View – An Important COVID-19 Filter

PERSPECTIVE is an important tool when assessing the economy or the stock market in times of volatility. Perspective is a broader lens through which we try to assess the scope and scale of all events that impact the economy and in particular the companies in which we make long-term investments. As it has been so well stated, it is not just a stock market, but a market of stocks.

S&P Composite Index Since 1900

In contrast, today’s headlines command our immediate attention to be focused on the short term. Click HERE read more of our quarterly letter.

Now is the Ideal Time to Review Your Long-term Financial Plan

Your investment portfolio is one piece of your overall financial picture. However, once a year, it is important to review your financial plan, and to take any necessary actions needed to reach your long-term goals.

Your investment portfolio is one piece of your overall financial picture. However, once a year, it is important to review your financial plan, and to take any necessary actions needed to reach your long-term goals.

At Penobscot, we have the ability to create comprehensive financial plans including: tuitions, real estate, philanthropy, social security, insurance, retirement and transfer of wealth objectives.

Using our in-house financial planning software, we can incorporate your short and long-term goals to help you create a customized plan to meet those objectives. These plans allow you to focus on your goals, address any concerns, and help you feel more educated and in control of your financial well-being.

Please let us know if you would like to work on a plan, and we can get started by sending you a questionnaire or email us.

Penobscot’s Outlook – A Market of Stocks

For the past decade, an investor who chose to invest in individual stocks or passive index funds enjoyed sustained growth. With the outbreak of COVID-19, companies and industries will be affected differently, some better, some worse.

The investor with a passively managed portfolio will be subject to the overall market trends brought forth by the outbreak. The investor with an actively managed portfolio can select individual companies and industries that will fare better in the near and long term.

Industry Sector

Total Return Q1 ’20:

For example, in Q1, 2020 Financials and Energy stocks were down 32% and 51%, respectively, while Technology and Health Care were down 12% and 13%. Even in stressful times like these, people will always need food and paper goods (Consumer Staples), computers and methods of payment (Technology), as well as medical prescriptions and instruments (Health Care). The table above are the total returns for the three top and bottom sectors of the S&P 500 for Q1 2020.

Personal Portfolios. Personally Managed.

At Penobscot, we build portfolios by forming relationships. Working as a true partner, we take the time to understand your goals and expectations. We ask questions. Share insights. Provide options. And we listen.

Then our accomplished managers join together to determine which investments make the most sense for your short- and long-term objectives. You benefit from our best ideas, united in one perspective — yours.