“The more things change, the more they stay the same”

“The more things change, the more they stay the same”

—Jean Baptiste Karr 1849

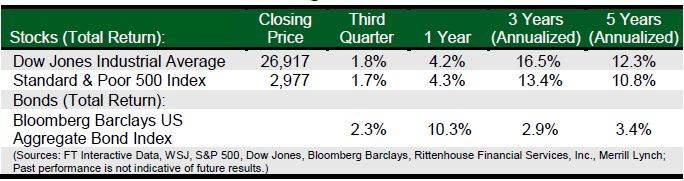

A year ago the 2018 3rd quarter closed with the S&P 500 Index and the Dow Jones Index at 2,914 and 26,458 respectively. As of September 30, 2019 those indices stood at 2,977 and 26,917. In sum, despite 12 months’ worth of tariffs, trade wars, Brexit battles, labor strikes, interest rate volatility and political turmoil the markets were little changed year over year. Yet, in calendar 2019 the indices are ahead by 20% and 17% respectively. How are investors to take the measure of such discrepancies between year over year versus year to date returns?

One consideration is that the markets spend much of the long passage of time with very little change and short periods of time with a lot of change. A study by Rittenhouse Financial for Merrill Lynch charted the market returns from 1987-1999 by the number of trading days, 3,131 days in that 13-year period. Investors who were out of the market for the 30 best days of that time frame missed approximately 50 % of the market’s annualized return. In other words, 1% of the trading days in that period provided approximately 50% of the returns. A more recent Merrill Lynch study accounting the period from 1999-2019 showed that missing the 10 top performing months out of 20 years cut returns by more than 50%. The conclusion from these studies is clear: “time in the market” is far more likely to produce positive returns than “market timing”.

We believe it is our responsibility to you, our clients to keep your assets invested as consistently and prudently as possible to capture the long term benefits of “time in the market”. We do that by understanding how you plan to use the funds entrusted to our care and then appropriately diversifying those funds between short term liquidity and long term growth assets. If we are successful, the vagaries of short term negative news events will have little impact on your long term returns.

As always, we appreciate your confidence in our management of your portfolios and invite your comments, questions or concerns.