PERSPECTIVE is an important tool when assessing the economy or the stock market in times of volatility. Perspective is a broader lens through which we try to gauge the scope and scale of all events that impact the economy and in particular the companies in which we make long-term investments. As it has been so well stated, it is not just a stock market, but a market of stocks.

PERSPECTIVE is an important tool when assessing the economy or the stock market in times of volatility. Perspective is a broader lens through which we try to gauge the scope and scale of all events that impact the economy and in particular the companies in which we make long-term investments. As it has been so well stated, it is not just a stock market, but a market of stocks.

In contrast, today’s headlines command our immediate attention to be focused on the short term. Coverage of the coronavirus and the global shutdown is riveting, and the fact that most of us are sheltering at home, lends itself to seeking frequent updates on the pandemic, business closures and the stock market retrenchment. The news feed is moment by moment with a bias towards headlines that attract and hold the largest audience. It is pervasive, and that pervasiveness has an undeniable influence on our thinking about our personal well-being and how the future may unfold.

At Penobscot, we invest for the long term and everything we do reflects that thinking. We remain true to our clients’ long-term goals over each business and market cycle. Acting upon short-term phenomena is a poor formula for managing for the long term.

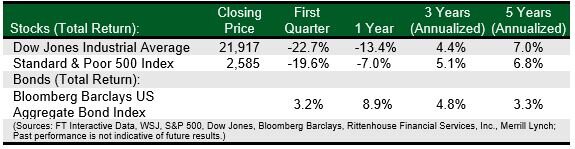

Accordingly, there are some lessons and landmarks from a long-term perspective. The Dow closed the quarter at 21,917, a level reached for the first time in 2017. Earlier that same year the Dow crossed the 20,000 mark, up from the low of 6,507 reached on March 9, 2009, more than tripling.

Between 2009 and 2017, there were many events that could have influenced investors to abandon stocks. Indeed, a large segment of individual investors in 2008 and early 2009 got out of the stock market and never got back in, missing one of the longest bull markets ever recorded. We know this because the majority of daily trading volume today is by institutions and investment firms, unlike in 2008, when roughly half of the daily volume was placed by individuals. Investing requires great patience and discipline, especially in times of uncertainty.

Dividend-paying stocks have and will continue to produce a growing stream of dividend income and reasonable returns over long holding periods. We have confidence in the management of the companies in which we have invested and their ability to navigate this challenging period. We adhere to a long-term perspective, a proven investment discipline, and resistance to acting upon emotion.

We encourage you to reach out to us with your questions or concerns. While we are working remotely, our dedication to providing you with the dependable service that you have come to expect is unchanged. From everyone at Penobscot, we send you our best wishes for good health which in itself is good perspective for enduring the economic challenges of the weeks ahead.