At Penobscot we take the long view when it comes to the stock market, and the first quarter of 2019 was a good reminder of the importance of a long-term focus. After the steep selloff last quarter left us with negative returns for the first year since 2008, this quarter was the strongest since 2009. The S&P finished almost 14% higher while the Nasdaq climbed over 16%.

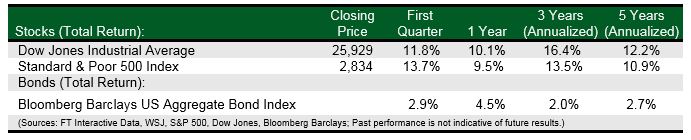

At Penobscot we take the long view when it comes to the stock market, and the first quarter of 2019 was a good reminder of the importance of a long-term focus. After the steep selloff last quarter left us with negative returns for the first year since 2008, this quarter was the strongest since 2009. The S&P finished almost 14% higher while the Nasdaq climbed over 16%.

Further, the impressive gain was in the context of an economy that is still facing many of the worries that were attributed to its decline in the fourth quarter of last year: a slowing global economy, fears of a recession, uncertainty around a trade deal with China and Brexit.

In fact, for the first time since August 2007, the yield curve inverted meaning that yields on the 10-year Treasury note fell below yields on the three-month Treasury bill. There is a lot of debate in the marketplace about what exactly an inverted yield curve implies and how much significance it should be assigned. Inverted yield curves have typically preceded recessions which has led to lots of discussion about what it might be forecasting.

The recession conversation began in earnest last quarter as markets tumbled. Pundits speculated that the stock market, typically a leading indicator, was signaling a recession. But as Paul Samuelson, the Nobel-winning MIT economist famously joked, the stock market has predicted nine of the last five recessions.

It’s too early to tell what the inversion means – it will be a different story if it remains inverted for months – but we think it’s safe to assume that the economy is slowing, but at what rate nobody knows. GDP was revised lower to 3.0% for last year and presumably the boost that came from the tax cuts is fading. The Fed, however, has declared a more accommodative stance suggesting they are carefully watching the array of economic indicators for signs of weakness.

We remain committed to screening out the day-to-day noise and taking the long view. A balanced portfolio of high-quality companies continues to be the most sensible approach in our estimation.

Finally, we have some timely and exciting news to report. After 30 years of leadership, Doug Hart has turned the reins as President of our firm to Dan Ford. Dan has been a Principal of Penobscot for ten years, and he is both prepared and motivated to build on Doug’s steady hand and care for our clients and the whole Penobscot team. While both Doug and Dan will continue in their roles as portfolio managers, it is our pleasure to announce the well-planned transition of President from Doug to Dan as we begin our fourth decade in service to you our clients.